Senior Tax Accountant

Senior Tax Accountant

What will you do?

- Assuring the VAT compliance across Europe, including preparation and filing of VAT returns,

- European Sales Listings, Annual VAT returns, Intrastat returns, refund claims, etc.

- Preparation of the replies to tax authorities’ questions, subject to manager review.

- Monitoring, assessing and managing the potential VAT exposures and outstanding VAT across Europe.

- Providing advice and assistance on a wide variety of VAT questions and issues across Europe.

- Providing support related to correct VAT codes for postings.

- Assisting the process teams (AP, AR) on correct tax treatment and VAT coding.

- Performing the balance sheet reconciliations (in Blackline) between SAP VAT reports and SAP accounting records and performing the necessary accounting follow-ups / adjustments.

Qualifications:

- Professional experience in SSC/BPO or Big4 would be an advantage

- Ability to learn and understand complex technical issues quickly

- Practical skills in MS Office (Excel: functions, pivot tables, v-lookup)

- Analytical skills with proactive approach

- SAP knowledge would be an asset

- Fluency in English

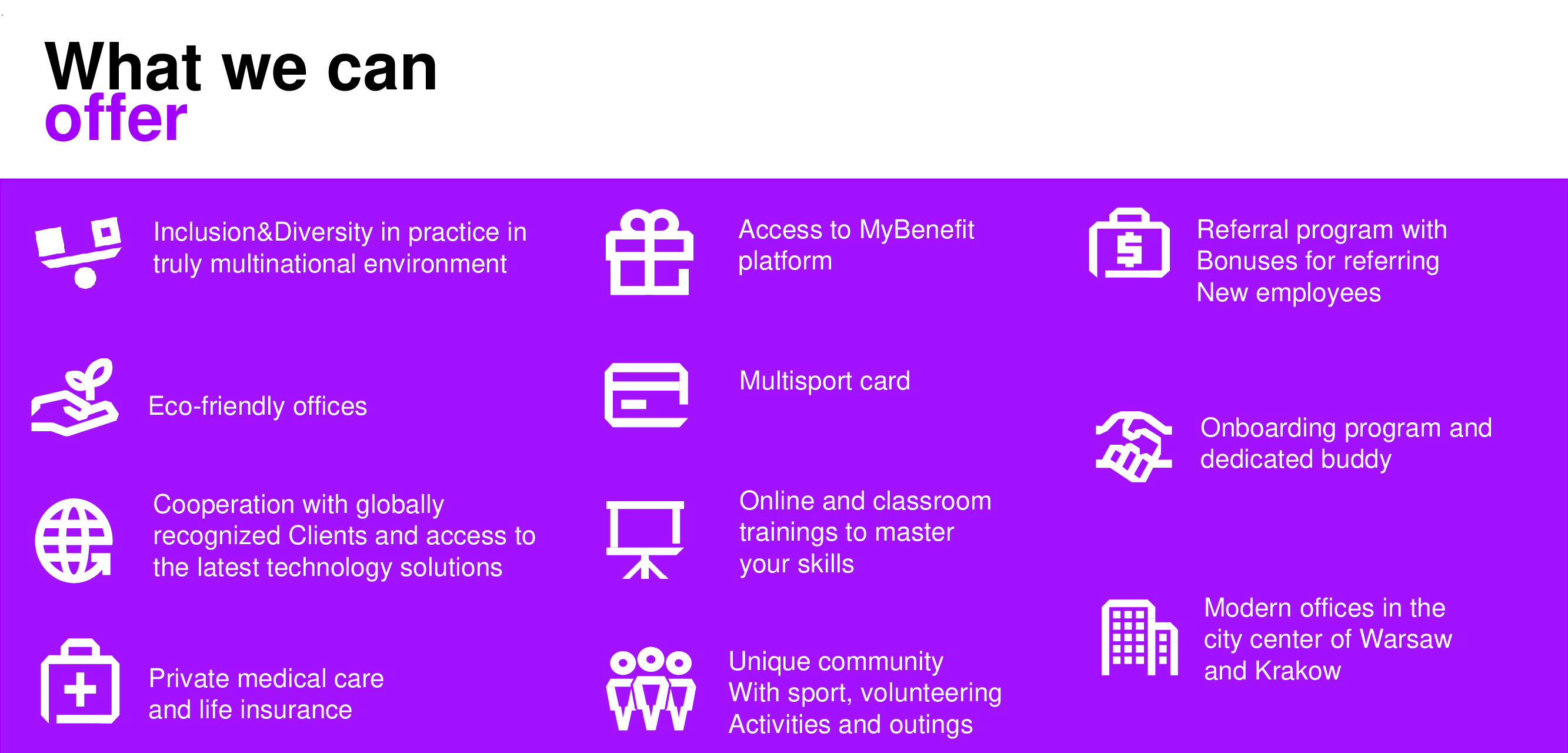

What we can offer

- Inclusion&Diversity in practice in truly multinational enviroment

- Eco-friendly offices

- Cooperation with globally recognized Clients and access to the latest technology solutions

- Online and classroom trainings to master your skills

- Onboarding program and dedicated Buddy

- Unique community with sport, volunteering activites and outings

- Access to MyBenefit platrofm

- Multisport and lunch card

- Private medical care and life insurance

- Referral program with bonuses for referring new employees

- Modern office in the city center of Warsaw

- Chill room, game room, library and coffee-breaks at terrace