Let us introduce you the job offer by EY GDS Poland – a member of the global integrated service delivery center network by EY.

The GCR team is part of EY’s EMEIA Tax Center (ETC). The ETC is unique to EY: we are the only Big 4 professional services firm with a dedicated center of excellence focused on delivering exceptional client service across borders. Our 570+ talented ETC professionals are based in 21 countries across Europe, the Middle East, India and Africa (EMEIA), and work with clients across the area, regardless of our location or theirs. We provide specialist tax, business and technology expertise to address clients’ most pressing challenges in an exciting, dynamic tax and business environment, through a broad range of innovative service offerings.

The GCR team comprises over 225 dynamic individuals spread across 13 countries and more than 20 offices. We have specialist tax and finance skill sets spanning the areas of Direct Tax Compliance & Reporting, Service Management, Indirect Tax, Statutory Reporting, Finance BPO, Funds Tax Management, and Payroll. We focus on supporting our clients in managing their compliance and reporting requirements, centrally and locally, and delivering on their transformation agendas. We are a team which embraces diversity and inclusion with a mix of cultures, nationalities and backgrounds. We believe this makes us perfectly suited to the global environment in which we work.

Our Direct Tax Compliance and Reporting team work closely with the client group tax function, acting as the primary point of contact and developing trusted business relationships across the account. We provide clients with global tax insights from their direct tax data across countries, major legislative and business changes which need to be planned for and tax opportunities which could deliver value. Our unique position enables the team to build a wide network across EY service lines and countries as they bring together all of the EY services and expertise available to meet their client needs. Our team work exclusively on large, multi-country compliance engagements, providing the opportunity to work with some of EY’s most complex corporate clients and giving a continued opportunity to learn and develop.

The opportunity

Join our fast-growing Global Compliance and Reporting (GCR) team as a Senior Tax Consultant. The role will give you the opportunity to work on EY’s largest multi-country client engagements in a tax accounting and direct tax capacity. You will have the opportunity to develop relationships with key accounts and provide your clients with global tax insights from their direct tax data across countries, major legislative changes which need to be planned for and tax opportunities which could deliver value.

The portfolio will consist of direct tax and tax accounting accounts (US GAAP or IFRS). You will be working with clients on established accounts, seeking process improvement opportunity in both EY and Client processes and implementing services for new clients. If you have a keen interest in tax processes and technology, you will have the opportunity to use these skills on a daily basis, as well as continuing to develop your tax accounting and direct tax knowledge.

Your key responsibilities

- Preparing simplified tax provisions computations and reviewing outputs from EY local country teams

- Assisting in coordination of client accounts

- Supporting on pursuits including response to RFPs

- Reviewing tax legislative updates and opportunities globally to share with our clients

- Coaching graduate trainees

- Reviewing local country tax outputs (such as reviewing Book to Tax Reconciliations for Corporate Income tax Returns on a global basis and compiling/understanding global tax analytics

- Key point of contact for EY local country teams

- Working with our Centres of Excellence in Philippines, Argentina and Poland

Skills and attributes for success

- Good communication skills

- An ability to distill complex concepts into simple messages

- Organized and able to manage your work load

- Experience reviewing codes, time and budgets

- Good foundation of tax concepts

To qualify for this role, you must have

- US GAAP and / or IFRS tax accounting experience such as provision preparation or tax audit work

- Accounting or tax qualification (ACA/ACCA/CTA/ATT or equivalent)

- An undergraduate degree

- Experience as a corporate tax practitioner

- Experience providing tax compliance assistance

Ideally, you’ll also have

- Project management skills, the ability to plan and prioritise work, meet deadlines and monitor own budget

What we look for

We are looking for individuals with a transformative mindset, people who can see past what we do today and dream up what we could do tomorrow. We want people who communicate well, work as part of a team and drive their responsibilities through to completion.

What we offer

EY Global Delivery Services (GDS) is a dynamic and truly global delivery network. We work across six locations – Argentina, China, India, the Philippines, Poland and the UK – and with teams from all EY service lines, geographies and sectors, playing a vital role in the delivery of the EY growth strategy. From accountants to coders to advisory consultants, we offer a wide variety of fulfilling career opportunities that span all business disciplines. In GDS, you will collaborate with EY teams on exciting projects and work with well-known brands from across the globe. We’ll introduce you to an ever-expanding ecosystem of people, learning, skills and insights that will stay with you throughout your career.

- Continuous learning: You’ll develop the mindset and skills to navigate whatever comes next.

- Success as defined by you: We’ll provide the tools and flexibility, so you can make a meaningful impact, your way.

- Transformative leadership: We’ll give you the insights, coaching and confidence to be the leader the world needs.

- Diverse and inclusive culture: You’ll be embraced for who you are and empowered to use your voice to help others find theirs.

About EY

EY | Building a better working world

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

If you can demonstrate that you meet the criteria above, please contact us as soon as possible.

The exceptional EY experience. It’s yours to build.

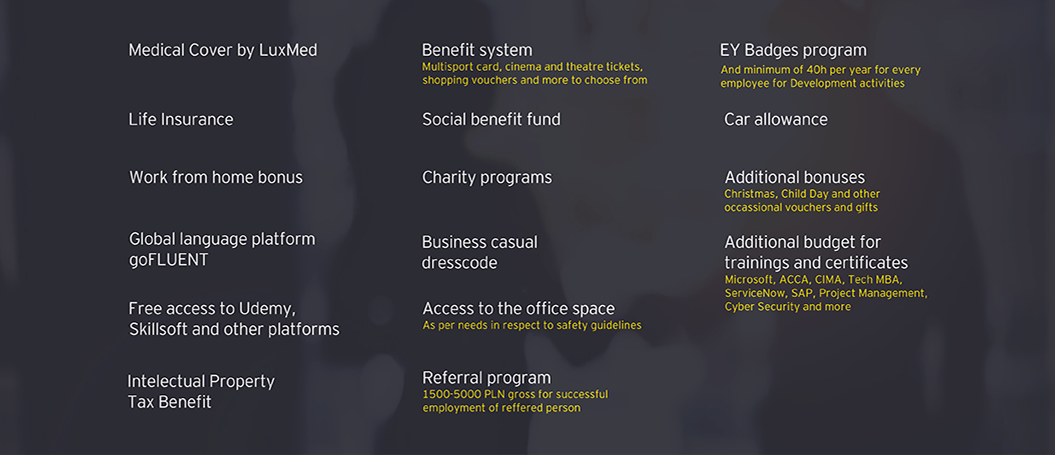

Benefits

- Medical Cover by LuxMed

- Life Insurance

- Work from home bonus

- Global language platform goFluent

- Free access to Udemy, Skillsoft and other platforms

- Intelectual Property Tax Benefit

- Benefit system

Multisport card, cinema and theatre tickets, ahopping vouchers and more to choose from - Social benefit fund

- Charity programs

- Business casual dresscode

- Access to the office space

As per needs in respect to safety quidelines - Referral program

1500-5000PLN gross for successful employment of reffered person - EY Badges program

And minimum of 40h per year for every empoloyee for Develompent activities - Car allowance

- Additional bonuses

Christmas, Child Day and other occassional vouchers and gifts - Additional budget for trainings and certificates

Microsoft, ACCA, CIMA, Tech MBA, ServiceNow, SAP, Project Maagement, Cyber Security and more