Let us introduce you the job offer by EY GDS Poland – a member of the global integrated service delivery center network by EY.

We advise clients on activities they’ve undertaken which meet the UK’s R&D tax criteria, and any expenditure they can claim a tax relief or credit for.

Our team is comprised of tax and IT specialists, who work together and use their expertise to advise clients on the UK R&D tax criteria. We are principally a UK based team with colleagues in the EY Global Delivery Service (GDS) hub in Bangalore.

We record our clients’ eligible activities via conference calls and write detailed technical documentation which substantiates their R&D tax claim of the UK tax authorities (HMRC).

Our technical discussions with clients cover a broad range of technologies, including software architecture and development (across numerous development languages), data and analytics, algorithmic and model development, infrastructure upgrades, cyber security, digital channels and distributed ledger technology.

The opportunity

- Join a highly successful, rapidly growing team, widely regarded as the leading R&D tax professional service provider in the Financial Services sector.

- Participate in technical conversations with numerous high-profile clients in investment, commercial and retail banking, as well as insurance, asset management, Fintech and personal lending providers, who are based (or have branches) in the UK.

- Build valuable knowledge of existing and new technologies in use by client teams, with exposure to people operating from software developer to C-suite stakeholder level.

- There may also be a chance to be involved in the team’s business development opportunities, participate in wider tax technology initiatives within EY, and be involved in the development of new service propositions by working closely with multiple UK teams

Your key responsibilities

- You will have more than 5 years’ experience working in or with technology teams (preferably a mixture of industry and professional services)

- You will have experience of conducting client facing conversations within a limited

- timeframe to capture information and provide guidance

- You will have built up a broad knowledge base of: software development principles, scripting languages and commonly understood technological knowledge (e.g. C++, C#, Java, JavaScript, Python, Json, XML)

- Established, commercially available technologies and their use (e.g. development environments, ETL tools, big data processing, database technologies, web technologies, cloud-based provisioning services, trade platforms, workflow tools)

- Technology project management approaches and their practical application in a working environment

- You will have a proven track record of writing structured, complex technical reports and documentation for senior review

- Ideally you will have prior experience working with financial sector clients and be aware of emerging technology trends

- You will have experience of managing multiple concurrent budgets and projects effectively

Skills and attributes for success

- You have excellent spoken and written business English, communicating clearly and concisely in phone calls and via email

- You must be able to rapidly digest, record and assess technical information captured during time-limited conversations

- You are proficient in the use of Microsoft Office applications (Excel, Word, PowerPoint, MS Project, OneNote)

- You can comprehensively and accurately capture business and technical conversations,– ideally with a typing speed above 60-70 words per minute

- You have an interest in extending your own technological knowledge and those around you

- You display a personable and professional approach to providing advice and guidance to clients

- You consistently show outstanding time management skills, and are always punctual and reliable

- You can diplomatically resolve differences of opinion, and maintain a positive attitude, through use of consulting skills

- You can comprehensively self-review documentation produced, and critically assess the applicability of a set of defined criteria to a range of technological scenarios

- You can build strong working relationships with colleagues and stakeholders both in the

- Bangalore office, and those working remotely in the UK team who you will directly report to

- You show initiative and take a proactive approach to delivering R&D tax projects end-to-end for our high-profile clients

- You are comfortable presenting to audiences of varying sizes and seniority

- You are always compliant with organisational quality and risk requirements, and can assess when and where issues need escalation

To qualify for the role, you must have

- Engineering background (equivalent degree preferred)

- 5 years’ experience working in or with technology teams (preferably a mixture of industry and professional services)

- Software development principles, scripting languages and commonly understood

- technological knowledge (e.g. C++, C#, Java, JavaScript, Python, Json, XML)

Ideally, you’ll also have

- Technology project management approaches and their practical application in a working environment

- You will have a proven track record of writing structured, complex technical reports and documentation for senior review

- Ideally you will have prior experience working with financial sector clients and be aware of emerging technology trends

- You will have experience of managing multiple concurrent budgets and projects effectively

- Strong analytical skills and attention to detail

- The ability to adapt your work style to work with both internal and client team members

What we look for

We’re interested in tax professionals with a genuine interest in providing outstanding services to some of the world’s most influential people. Working with people from all backgrounds, from executives and entrepreneurs to investors and families, you’ll use your experience and status as a trusted advisor to maintain and further our reputation for excellence.

What we offer

EY Global Delivery Services (GDS) is a dynamic and truly global delivery network. We work across six locations – Argentina, China, India, the Philippines, Poland and the UK – and with teams from all EY service lines, geographies and sectors, playing a vital role in the delivery of the EY growth strategy. From accountants to coders to advisory consultants, we offer a wide variety of fulfilling career opportunities that span all business disciplines. In GDS, you will collaborate with EY teams on exciting projects and work with well-known brands from across the globe. We’ll introduce you to an ever-expanding ecosystem of people, learning, skills and insights that will stay with you throughout your career.

- Continuous learning: You’ll develop the mindset and skills to navigate whatever comes next.

- Success as defined by you: We’ll provide the tools and flexibility, so you can make a meaningful impact, your way.

- Transformative leadership: We’ll give you the insights, coaching and confidence to be the leader the world needs.

- Diverse and inclusive culture: You’ll be embraced for who you are and empowered to use your voice to help others find theirs.

About EY

EY | Building a better working world

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

If you can demonstrate that you meet the criteria above, please contact us as soon as possible.

The exceptional EY experience. It’s yours to build

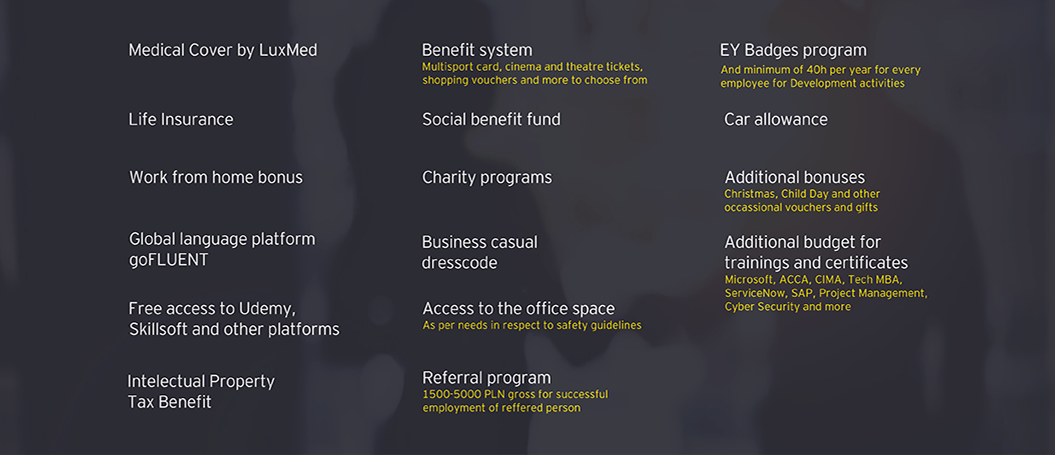

Benefits

- Medical Cover by LuxMed

- Life Insurance

- Work from home bonus

- Global language platform goFluent

- Free access to Udemy, Skillsoft and other platforms

- Intelectual Property Tax Benefit

- Benefit system

Multisport card, cinema and theatre tickets, ahopping vouchers and more to choose from - Social benefit fund

- Charity programs

- Business casual dresscode

- Access to the office space

As per needs in respect to safety quidelines - Referral program

1500-5000PLN gross for successful employment of reffered person - EY Badges program

And minimum of 40h per year for every empoloyee for Develompent activities - Car allowance

- Additional bonuses

Christmas, Child Day and other occassional vouchers and gifts - Additional budget for trainings and certificates

Microsoft, ACCA, CIMA, Tech MBA, ServiceNow, SAP, Project Maagement, Cyber Security and more